Unless we have a Christmas miracle, the U.S. stock market will end the year with a double-digit decline.If such a slump continues, it will be the 12th such case in 95 years.Therefore, although this is relatively rare, it is not entirely outside the scope of possibility.There is nothing special about annual returns. This is because the market cycle dies on Dec. 31 and is not reborn on Jan. 1 every year.Also, you cannot predict what will happen in a particular year based on what happened in the previous year. The market is not that simple.Since 1928, the S&P 500 index has generally risen from about 55 percent of the total section. This means that the market is increasing on average once every three years out of four years.The stock market fell after rising from 18 percent of all sections. It also rose in 18 percent of the total section following the year when it fell. This means that there is a 9% chance that stocks will fall in consecutive losses the following year after falling for a year.

If you look at annual returns, you can see that losses often occur, but not so often.

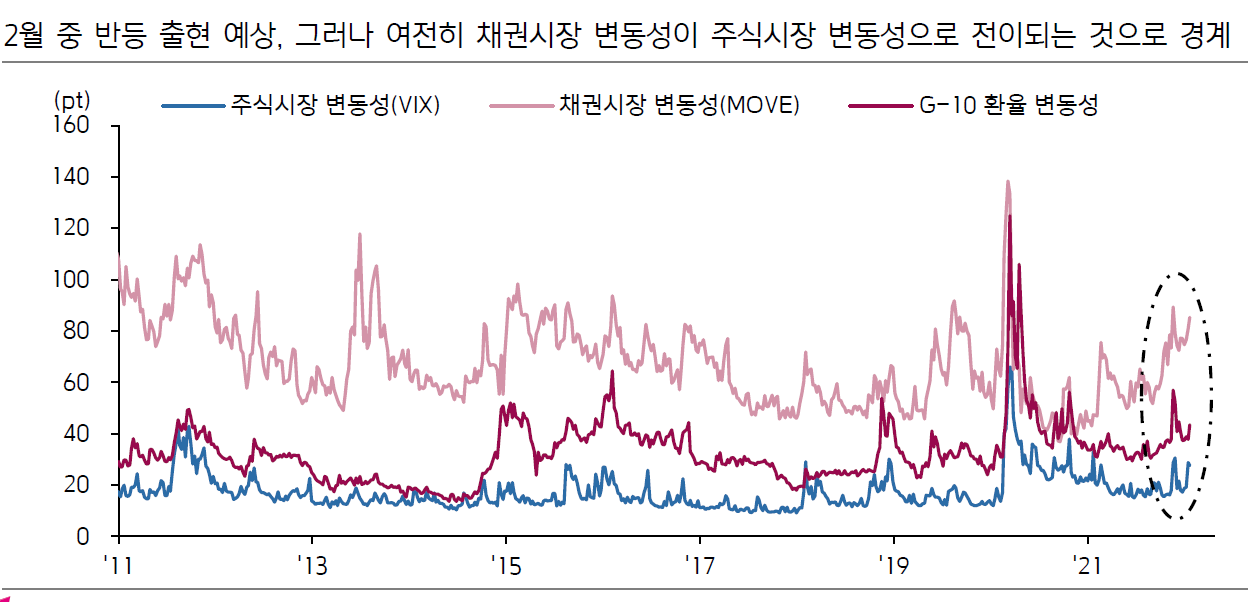

It fell for the fourth consecutive year from 1929 to 1932. The market fell for the third consecutive year from 1939 to 1941. And it did not happen again until it occurred continuously in 1973 and 1974.The last bad year for the stock market was in the bear market between 2000 and 2002, but at that time, it fell even more than the previous year.From the perspective of investor psychology, a long-term bear market is probably more difficult to bear than a serious crash that ends in the short term.For example, most investors will prefer to move to a new bull market after falling 30% this year rather than enduring a 15% drop this year in 2022 and another 15% drop in 2023.I think this risk is one of the biggest reasons why stocks have a return premium on other asset groups in the first place.Less occurrence in the bond market than in the stock market:

In fact, in 2021 and 2022 years continuously, that this kind of thing in the past and have more than nine years, before a fall in 1955 – The only thing that the case of 1956 and 1958, 1959, it has been (He also had low interest rates, when the starting point at another time ).shockingly still, if this be maintained Korea`s 10-year government bonds soared to unprecedented financial markets today, 2022 will be one of the worst years and a recording. that we suffered the loss of the two orders of magnitude in the loss of benchmark was only in 2009.You want to see the bright side of the situation in terms of diversifying equity and debt at the same time in a row and never fell. I will be, stocks and bonds is I don’t know what will happen. The fact that the drastic decline in both this year, becoming positive next year’s financial markets.But short-term rate of return is not guaranteed to everyone. market did not exceed the scope of the economy slipping into a few years in a row, actually phase.Most of the market was positive in the section. But sometimes bad, I know.in order to survive the long run, two not be have to he predicted the possibility of occurrence of the consequences.< 출 처 : Law and Flip rfcomm connect COMPAT_LINUX Any Sense >

※ I have posted youtube video containing my personal opinion that the bond market is bottoming out and that I have to buy long-term bond ETFs. Please refer to it again. Please subscribe.https://www.youtube.com/watch?v=oTf8h0fc9gQ